Make your money go further

Imagine a world where late fees and overdrafts disappear forever.

.avif)

You’re counting the days to payday

There’s barely enough money to last between this payday and next. Living like this? It’s exhausting. But what if you had a pile of money waiting for bills instead of a pile of bills waiting for money? Imagine the relief.

We’ll teach you how to live on last month’s money so you never feel that razor-thin financial edge again. You can stop worrying about maxing out your credit cards, collectors will stop calling, and those once-frequent overdraft fees will vanish into thin air.

We’re here to help

We want to help you build more breathing room in your bank account and in your life.

1. Start your trial

Try YNAB for free. Poke around a bit. Decide if this is the tool for you!

2. Create your plan

Build a buffer with your money and track your progress.

3. Get ahead

Watch your money stretch to payday and beyond and build a financial security blanket.

.svg)

I created my own financial security

I know how horrible and embarrassing it can be to have your card declined. I was that girl.

Break the cycle for good

When Dana Kay saw that the woman in front of her at the grocery store had her card declined at the register, she immediately swept in to cover the woman’s costs. That’s when she realized how far she had come from living paycheck to paycheck. Hear how she turned it all around.

What’s your money pain point?

Help! I don’t know where to start.

When no one ever taught you what the heck to do with money, it’s no wonder you’re a little lost! First things first, let’s get YNAB to light your way.

Get StartedHelp! I don’t make enough money.

Are you stuck thinking that you can't manage money if you don't have enough of it? Here’s how to thrive no matter how much you have in the bank.

What to DoPractical tools for getting ahead

Read the Full Guide

This guide will take you through how to break out of the paycheck to paycheck cycle forever in an easy-to-follow format.

Take a Free Class

Our teachers will show you how to plan no matter when you get paid next. Ask your questions and get answers in real time.

Learn to Live Spendfully

YNAB is more than an app. Watch this video to learn how to practice the YNAB Method.

How to Get Ahead

Learn how to live on last month’s income so you have more space between when you’re paid and when you get paid again.

Read real money stories

.avif)

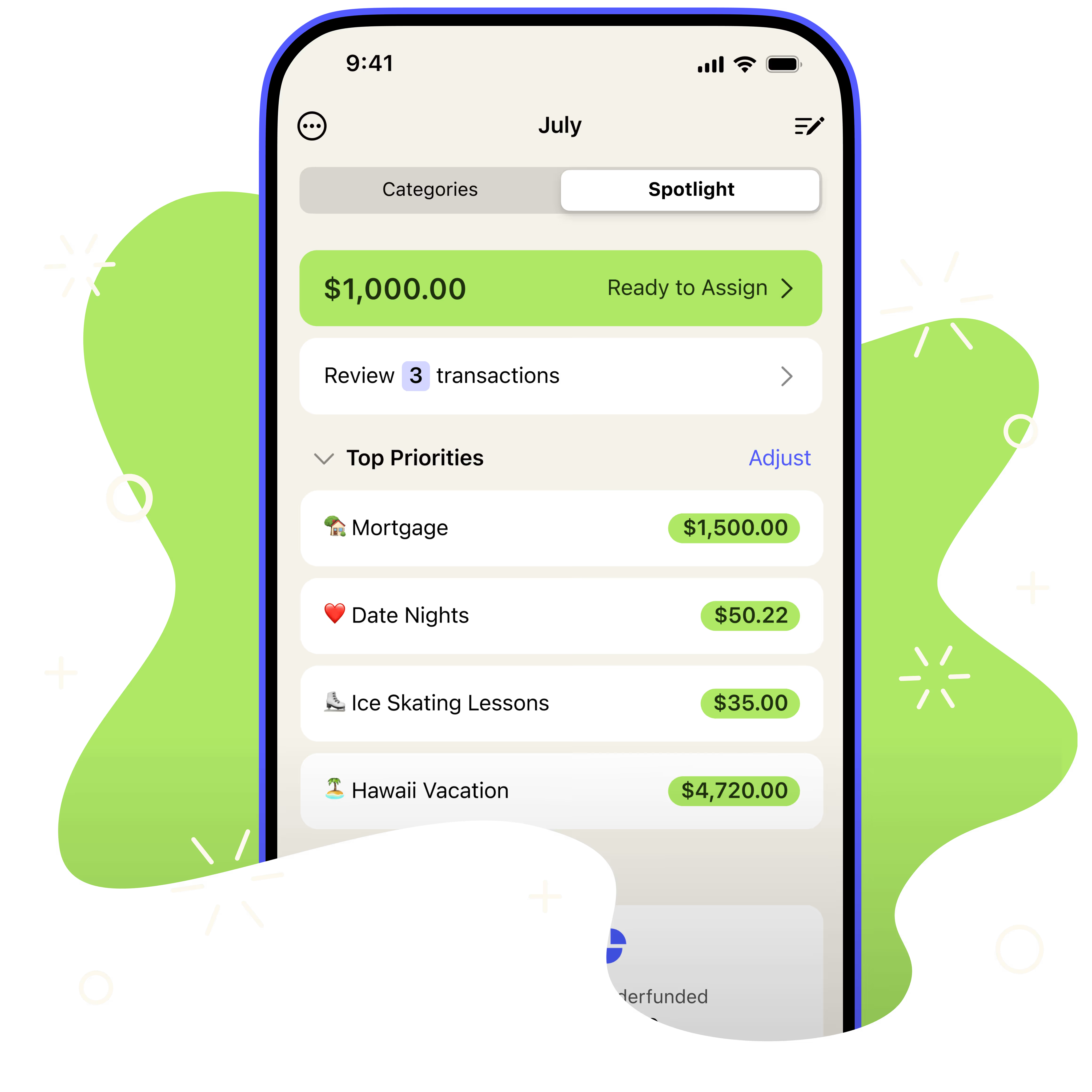

From Missed Mortgage Payments to Vacation Funds

To those who are currently feeling desperate: the small, day-to-day decisions will start to add up and soon will feel like progress.

True Confessions: We Lost Our Home

Natalie and Larry went from living paycheck to paycheck to saving enough money to reach their dream of adopting a child.

From Paycheck to Paycheck to Near Perfect Credit

Angela Stevens and her family of six were living paycheck to paycheck. Then one day, it all started to change.

.svg)

.png)

.svg)

.svg)

.svg)