34 days to get good with money

Stop worrying about where your money goes. Start deciding where it will take you.

.avif)

14 people have personalized license plates that say YNAB.

No, they don’t work here. No, we didn’t ask them to do that. Pretty cool, huh? It’s proof that YNAB changes more than how you manage money. YNAB changes lives—in a way that makes people want to shout it from rooftops (and Range Rovers).

Never worrying about money again changes everything. Start your trial today.

.avif)

34 days to less money stress—for free!

As much fun as the free samples at Costco, but even more life-changing than cheese.

See what other YNABers had to say:

.svg)

I paid off $1,500 in my first month of YNAB

The day we started YNAB we were nearly $20,000 in debt and only had $300 for an emergency. One year later, we've saved $18,000 and have paid off almost half our debt.

.svg)

I have a lot less stress

I have money in my savings account for the first time in 10 years.

It takes me 30 seconds per day

I tried other programs—it was all just a whole lot of work, and I never had a clear sense of how we were actually doing. YNAB has made a huge difference in my awareness and day-to-day decision making.

Here’s how it works

Start your free trial

Get started right away with just your email—no credit card required. Experience the wonders of YNAB for 34 days.

Learn the YNAB way

Access live classes or recorded workshops anytime, along with our entire roster of educational content—always free, oddly fun.

Never worry about money again

Achieve goals, improve relationships, and sleep easier knowing that your money is funding a future you’ll love to live.

Why 34 days?

Most free trials are for 30 days. However, many months have 31 days. And don’t even get us started on February, that situation is wild. Anyway, you don’t see the real power of zero-based planning until the month rolls over, so we wanted to make sure you had plenty of time to feel the magic of giving every dollar a job. 34 days just felt right.

.avif)

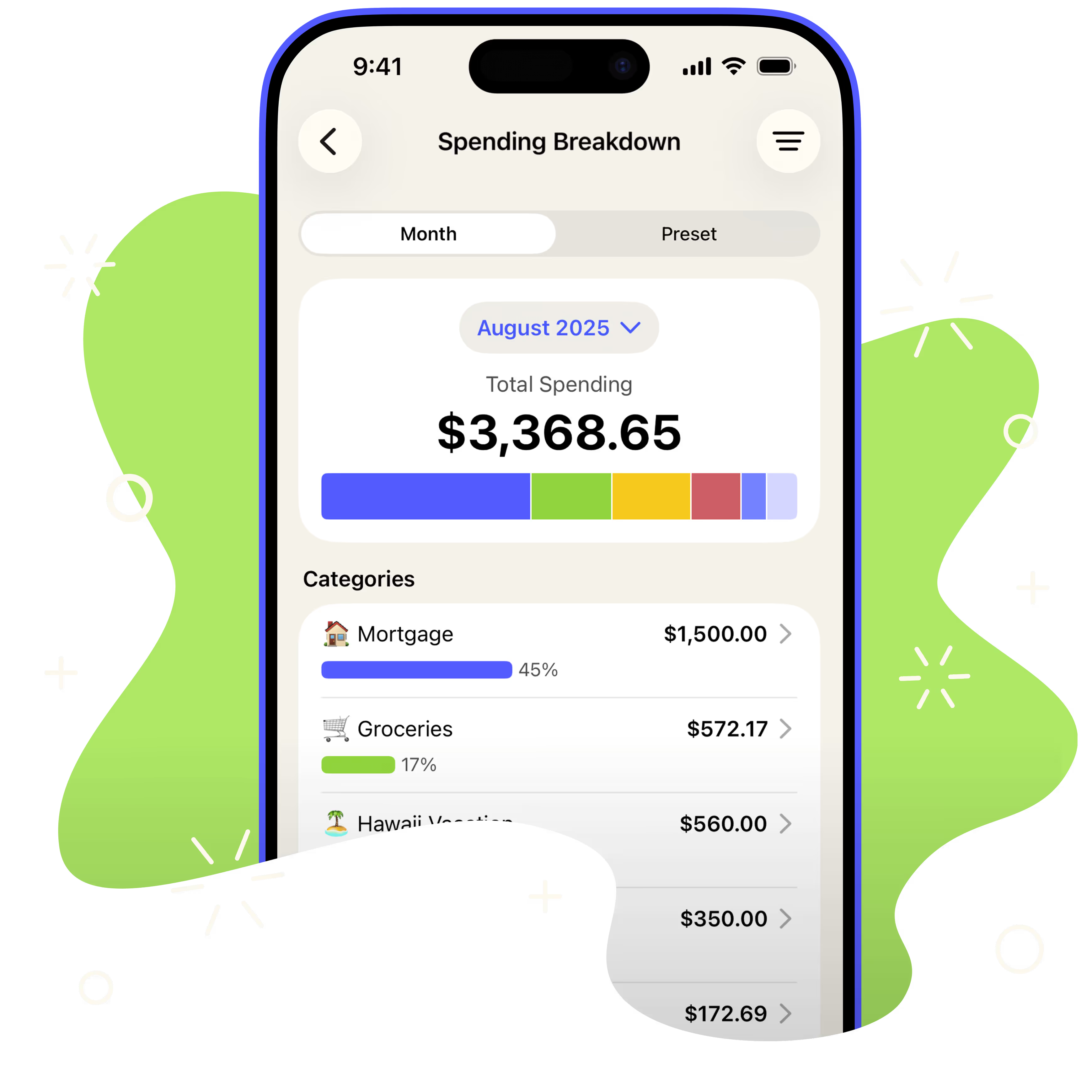

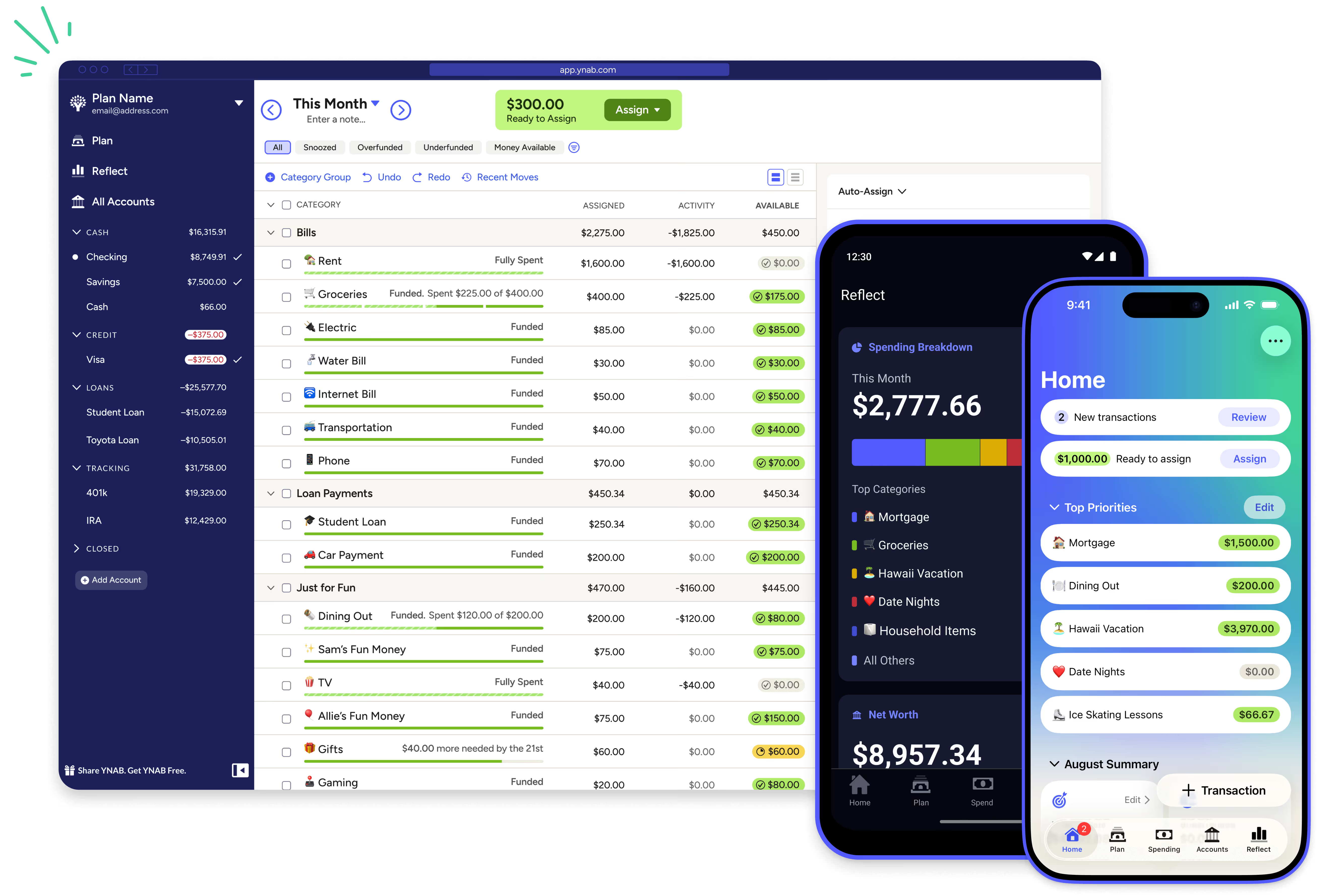

Here's what you get during your trial

(Plus the satisfaction of getting good with money)

Full access to YNAB

With YNAB, you’ve got options! Use YNAB on mobile or web, sync bank accounts or enter transactions manually, and share your subscription with loved ones.

A tool you can trust

Your data is private—it’s yours and only yours and that will always be true here. We never sell user data of any kind, whether you’re a subscriber or trying the free trial.

A wealth of resources

Join a live workshop with one of our world-class educators, watch informative (and entertaining) videos, read helpful (and humorous) articles, and join community challenges for extra support. All free!

Award-winning support

Our support team is Mr. Rogers-level friendly and is available via chat or email to answer every question! They’ve even been known to send memes and customized videos for highly personalized support.

.svg)

.png)